ncreif regions|Iba pa : iloilo The NCREIF data products are broken out based on investment type, which are . Good job, congratulations to Miel Fajardo and his team, and happy new year from Philboxing, the Filipino boxing portal. Photos by Carlos Costa for Philboxing The author veteran reporter Carlos Costa was at ringside in Bangkok. Carlos can be reached at

[email protected]. Click here to view a list of other articles written by Carlos Costa.

PH0 · npi index real estate

PH1 · ncreif property index returns 2019

PH2 · ncreif property index q4 2022

PH3 · ncreif property index 2022

PH4 · ncreif property index 2020

PH5 · ncreif odce index

PH6 · ncreif odce

PH7 · national council of real estate investment fiduciaries

PH8 · Iba pa

Time Zone Converter from 9pm in Eastern Time Us time. Easily find the exact time difference with the visual Time Zone Converter. Find meeting times for your contacts, locations and places around the world. Never warp your brain with time zone math again.

ncreif regions*******NCREIF is the leading provider of investment performance indices and transparent data for US commercial properties. Data Contributor Members submit data to NCREIF for inclusion in its various indices and data products.National Council of Real Estate Investment Fiduciaries. 105 West Madison Street, .

NCREIF is an association of institutional real estate professionals who share a .The NCREIF data products are broken out based on investment type, which are .Conferences and Events - NCREIF | National Council of Real Estate .NCREIF member firms include leading investment management firms with well .

NCREIF's Joe D'Alessandro will be joined by Mike Acton, Head of Research at .The NCREIF data products are broken out based on investment type, which are Property, Fund, Farmland, or Timberland and is presented by Fund Type, Property Type, Subtype, .The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only. All . News from NCREIF. Here you will find the most recent NCREIF Data Releases, Conference Announcements, NCREIF Academy Announcements, Global .

NCREIF aggregates the confidential individual property data provided by members and provides indices based on aggregate data for use by its members and the real estate .ncreif regionsThey can be broken out and viewed by specific property types, regions, metro areas, zip codes, fund type or any combination of. In addition properties can be filtered for specific .NCREIF supports the investment community with guidance on using its detailed property database and portfolio of fund indices to further thought leadership in the industry. .Iba pa CHICAGO, IL, July 26, 2021 – The National Council of Real Estate Investment Fiduciaries (NCREIF) has released second quarter 2021 results for the NCREIF Property Index (NPI). The NPI reflects .NCREIF Property Index Trailing One-Year Returns by Region and Property Type. Appreciation Income 10.9% Source: NCREIF, ODCE return is net. U.S. Private Real .Latest NCREIF Index Returns. NCREIF Members should Login to view detailed data and reports. You can view the latest index return Press Releases and Snapshot Reports in .

The NCREIF Property Index (NPI) Trends is a quarterly report that tracks the changes in both capitalization rates and net operating income (NOI). Within the quarterly NPI Trends spreadsheet file, the trends in capitalization rates or “cap rates” computed from the NPI properties sold each quarter are detailed across each major property type . National NCREIF Property Index annual return in the U.S. 2024, by property type Commercial real estate cap rates in the U.S. 2012-2023 with a forecast until 2024 Vacancy rate of commercial real . Record High for Industrial Properties Propel Institutional Real Estate to Highest Returns in Ten YearsCHICAGO, IL, July 26, 2021 – The National Council of Real Estate Investment Fiduciaries (NCREIF) has .

National NCREIF Property Index annual return in the U.S. 2024, by property type Commercial real estate cap rates in the U.S. 2012-2023 with a forecast until 2024 Vacancy rate of commercial real .

Investment research can utilize NCREIF data and analytical tools to support more informed decisions about real estate investment strategy, portfolio construction and asset positioning. . When we calculated the 12-month rolling returns for the respective regions, we found that ANREV realized a 12-month rolling total return of 7.59% compared .They can be broken out and viewed by specific property types, regions, metro areas, zip codes, fund type or any combination of. In addition properties can be filtered for specific market value ranges, square feet, number of unit or floors, and many others. For a complete list of query tool features please contact the NCREIF office at info .The NCREIF Fund Index – Open-End Equity (NFI-OE) was released in 2012 with data going back to First Quarter 1978. NFI-OE is an aggregate of open-end, commingled equity real estate funds with diverse investment strategies. Funds comprising NFI-OE have varied concentrations of sector and region, core and non-core, leverage and life cycle.ncreif regions Iba paThe NCREIF Fund Index – Open-End Equity (NFI-OE) was released in 2012 with data going back to First Quarter 1978. NFI-OE is an aggregate of open-end, commingled equity real estate funds with diverse investment strategies. Funds comprising NFI-OE have varied concentrations of sector and region, core and non-core, leverage and life cycle.

The NCREIF Fund Index - Open End Diversified Core Equity (NFI-ODCE), is an index of investment returns of the largest private real estate funds pursuing lower risk investment strategies utilizing low leverage and generally represented by equity ownership positions in stable U.S. operating properties diversified across regions and property types .

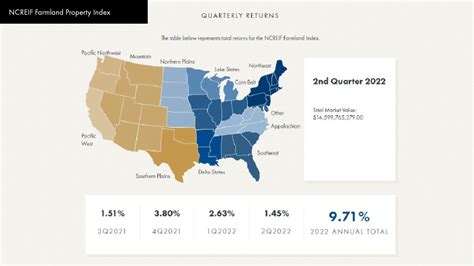

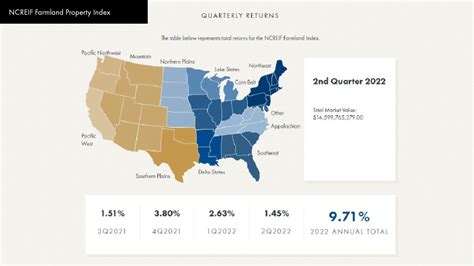

American Society of Farm Managers and Rural Appraisers, Inc. 720 South Colorado Boulevard, Suite 360-S. Glendale, CO 80246-2664 (303) 758-3513. Contact Us It compares those returns (on a 1-year basis) to the annualized return of each category since inception. Most regions report data/analysis as far back as 4th Quarter 1990. As such, some of the annualized returns ‘since inception’ are based on roughly 32 years’ worth of data. Overview. NCREIF Farmland Property Index 2022 2nd Quarter . A +. 100%. Inflation and war in Ukraine helped spur nearly 30 percent growth in Corn Belt annual cropland values over the past year, according to the National Council of Real Estate Investment Fiduciaries. .NCREIF maintains sub-indices for the five property types, 18 property sub-types, four regions and eight sub-regions. Office, industrial and retail property indices begin in fourth quarter 1977, while the apartment and hotel property index begins in third quarter 1984 and first quarter 1997, respectively. Returns are weighted by market value and are

The NCREIF (National Council of Real Estate Investment Fiduciaries) Academy offers a collection of courses that are specific to our institutional real estate industry, and designed to offer NCREIF’s members and other professionals with the opportunity to explore the industry’s different disciplines. Over the years a strong and diverse .This thesis builds on the endogenous relationship between transaction price and volume in commercial real estate markets in order to construct a simple “constant-liquidity price index” (SCLI) applicable to general transaction databases such as that of Real Capital Analytics Inc (a MIT/CRE member firm). By recognizing the fact that current commercial property .NCREIF’s historical property and fund database go back to the Fourth Quarter 1977 and consists of over 35,000 properties and over 150 open-end and closed-end funds. The NCREIF data products are broken out based on investment type, which are - Property, Fund, Timberland, or Farmland. There is also a NCREIF Analytics section which .

Returns for the quarter were positive across all regions. The South region had the highest return of the quarter at 5.35%, comprised of 0.77% EBITDDA and 4.58% appreciation returns. The Northwest, Lake States, and Northeast regions returned, respectively, 3.14% 1.80% and 0.42% for the quarter, driven by appreciation returns of 2.55%,1.29% and 0 . The verbiage below is quoted directly from the NCREIF Farmland Property Index 2022 4th Quarter Results: . All Regions’ total is extremely consistent, with the 1-year annual return at 9.64% as compared to the annualized return since inception at 10.65%. However, Permanent Cropland in All Regions has had a historic run since inception well .NCREIF's Hotel Index. In Q4 2020, NCREIF’s National Property Index (NPI) included 9,289 U.S. properties worth over US $700 billion. The NPI has many variants of the national aggregate index, including commercial property type indexes for apartment (1,943 properties), hotel (69 properties), industrial (4,387 properties), office (1,610 .

9 am EDT: is : 3 pm in Copenhagen: 10 am EDT: is : 4 pm in Copenhagen: 11 am EDT: is : 5 pm in Copenhagen: Eastern Daylight Time (EDT) to Copenhagen, Denmark ( in Copenhagen) 12 pm EDT: is : 6 pm in Copenhagen: 1 pm EDT: is : 7 pm in Copenhagen: 2 pm EDT: is : 8 pm in Copenhagen: 3 pm EDT: is : 9 pm in Copenhagen: 4 pm EDT: is :

ncreif regions|Iba pa